The #1 Move That Took Me to the Big Leagues

Plus: A live look at my new ad campaign ($1.80 leads?), and the truth about how financial promos actually get made.

Since I had Q&A issue last week I got a lot more questions, so I figured I’d do another one today PLUS update you on how my new informational product campaign is going.

First let’s take a look at Inder’s question, who wrote…

Hey William…not sure if this is a good question or not but figured I would ask to get the ball rolling here.

What’s the #1 move you’ve made in your copy career that created the biggest leap in income — and what would you do differently if you had to do it again?

Cold emailing by far. That’s the “thing” that took me off sites like Upwork and put me in the big leagues.

I wrote a more in depth story about how I transitioned into those better jobs HERE but in a nutshell it was just emailing people directly and deciding to charge a much higher price even though it scared me.

As far as what would I have done differently if I had to do it again?

Well — I would have done it years sooner and saved myself a lot of depression and feelings of utter worthlessness.

Aleksa Bacilovic wrote…

Apart from client work, how do you keep your copywriting sharp?

Any special routines or practice exercises?

Another thing I'm interested to see is how you manage your time working with multiple clients.

For keeping my copywriting sharp, it really comes down to constantly keeping my eyes open.

For example, let’s say I’m just mindlessly browsing through YouTube and I click on a video.

And this is my off time when I’m working on let’s say a supplement Facebook campaign.

I might pause and ask myself “Why was I so eager to click on this video?”

Was it the title of the video? Was it the thumbnail pic / caption?

Can I adapt that into an ad for this supplement I’ve been working on?

One recent example would be this video I came across:

That instantly got my attention.

And right away I saw how it could make a great hook / headline / lead combination for social ads.

For example “7 Totally Wrong Facts About Weight loss Everyone Still Believes”

I’m always paying attention to ads I see anywhere online…

Promotional emails…

Lines in books I’m reading, titles of movies, lines in movies, anything catching fire in popular culture and so on.

When I see things I like I’ll drop it into a Google Drive folder and add to my ever growing swipe file.

When I’m ever at a lack of inspiration or I just can’t figure out an idea — I’ll go back in that swipe file and just start browsing until I see something I can adapt.

So I don’t really have a set system, but I’m just always looking around.

Regarding juggling multiple clients, I wish I had some sage-like advice for you. But to be honest, it’s just that I’ve been doing it for so long I don’t even really think about it.

When I was broke I took every job I could and never said “no” to anything.

That unwillingness to say “no” kind of stuck with me and so from time to time I’ll “yes” myself into way too much work and have to stage a kind of client culling.

For me, 2 to 3 clients at a time is fine. Anything over that and I start hating my existence. I can sustain it for a bit, but then eventually get burned out.

Richard wrote…

In your experience…

What comes first in a financial promo, the big idea/thesis, or the product?

For example, what if I come up with a cool promo idea and the publisher has no product or gurus who promote that kind of stocks, assets, etc?

I've heard from industry insiders that publishers will sometimes create a product from thin air if you have a solid idea.

But how does the process actually look like in your experience?

I’d love to know how the whole thing unfolds inside the FinPub world.

There's a promo by Jim Rickards where he mentions inventing an algorithm that predicts or monitors what stocks will take off.

He supposedly invented it in the 90s while he was working for the Pentagon.

(Not entirely sure if it was in the 90s or 00s. I can’t find the promo to double-check.)

Is this a factual story or just the dramatization of an AI algorithm he came up with recently?

Do we have to find a promising stock, outline the whole stock story, and then the publisher will create a product? Or do we need to see their products/services and then search for cool stock stories that fit their products? Or will the stock analysts/gurus give us that info?

Regarding which comes first? It really just depends.

Sometimes a client in the financial space will say “Hey — we want you to create a promotion for this specific product/service” and I don’t really have any ideas in mind to start.

Other times I have ideas locked and loaded and I can tell you that I can essentially adapt those ideas to any service.

Because the service is just a strategy, but the big idea is not strategy-dependent. It’s something wider happening in the world.

But this isn’t always the case.

So take for example a big idea like The Bloodbath Millionaire System — how to profit even in market bloodbaths.

Let’s say I’m working on a service that’s long only (meaning it’s just buying stocks. No shorting. No options like long puts, credit spreads, debit spreads and so on).

I COULD still make it fit, if I go back through the model portfolio’s track record during bearish market periods (2022, 2020, 2018, or even this year after the “Liberation Day’ tariffs were announced the market dropped over 10%).

Let’s say I did that and while most stocks were going down, his portfolio outperformed.

That would still work.

But if that’s not the case — then that “big idea” just doesn’t fit and will have to be shelved.

Now, if your big idea is asset-dependent or sector dependent that’s another story.

Like if your idea is that oil is going to rise or that the energy sector is going to take off or AI is a bubble and so on, then the editor of the service is going to need to align with that viewpoint.

Because it won’t be wise to get a whole bunch of new subscribers in there who are — for example — expecting the AI apocalypse and stocks that are going to save them during that AI apocalypse and the “guru” starts writing recommendations to buy Nvidia due to its strong AI correlation.

Just not going to work.

Or you talk about energy sector taking off, but the editor doesn’t really have the same idea and doesn’t want to recommend any energy stocks.

That won’t work either.

In situations like those, you’d usually read through a lot of the editor’s work and get to know their strategy and overall worldview and then find something happening in the world that works with it.

Do publishers sometimes create a product from thin air? Sometimes. Or…they used to.

For example my marketing direct at Wyatt used to be the director at Wiess Research and he told me that copywriters would have an idea, write a full promotion, and just tell the editor “find a stock that fits.”

It’s not really done like this anymore, though. And it shouldn’t be, in my opinion.

As someone who has been both a copywriter AND now and editor / guru — it’s infuriating.

I cannot tell you how many times a copywriter injects promises or bonuses into their copy that don’t even exist in my service and do not even align with my trading principles.

And yes, they do often try to make the argument of “Well you can just start doing that” and it causes a lot of bottleneck and back and forth that could have been avoided, if the copywriter didn’t try to conjure bullshit up out of thin air that I do not offer, do not believe in, and actively try to avoid.

For example I do not sell puts or credit spreads in my service (or if i do it’s very rare when IV is high).

But on a previous promotion one bonus the copywriter tried to offer was something like “Every trade also comes with a ‘Put Selling for Income strategy.’”

If they had spent time reading ANY of the special reports or weekly issues I had written for my subscribers they clearly have seen how many times I voiced my disdain for put selling and credit spread strategies and even explained why I do not use them.

So I don’t necessarily agree with that way of doing things.

For me, typically the process is I read everything I can from the editor and look over their strategy and their track record.

Then I start to form ideas.

But because I’m so inundated in the financial landscape already, I usually have vague ideas ‘pocketed’ that can be applied at least partially to any service I’m working on.

Regarding Jim Rickards — I’ve never worked on any of his products.

But I do know his primary claim to fame is that he worked as a financial advisor for the CIA and DOD and helped create / facilitate financial war games.

He also helped negotiate the 1998 bailout of Long-Term Capital Management which almost blew up the world’s markets and exacerbated the Asian Financial Crisis.

At the end of the day — most of the time you are relying on information from the service itself. You are not finding individual stocks (that’s the editors job) or trade ideas.

So How Is My Info-Product Going?

Currently the team is still building out everything.

But recently my media buyer convinced me to just run some “brand awareness” ads to get a lookalike audience going and some emails.

And to do so through Facebook lead forms, which I’ve never used before.

I agreed.

First — I filmed two sets of videos for the ads.

Both on the beach. Once sitting down and one walking.

Each set had…

15 sec version

30 sec version

1 minute version

2 minute version

I used AI to write the script (Claude specifically) and AI to write the text ads, which you can see HERE in a Google doc.

Of course I provided custom instructions and used my webinar deck on the project for its inspiration.

Filming the videos was very hard for me because I am deeply uncomfortable putting myself out there like that.

I’m always behind the scenes writing for somebody else, so to be “the guy” saying “Hey here I am at the beach making $27,000 a month writing a couple hours a day’ just made me feel hokey even if it it is LITERALLY the truth.

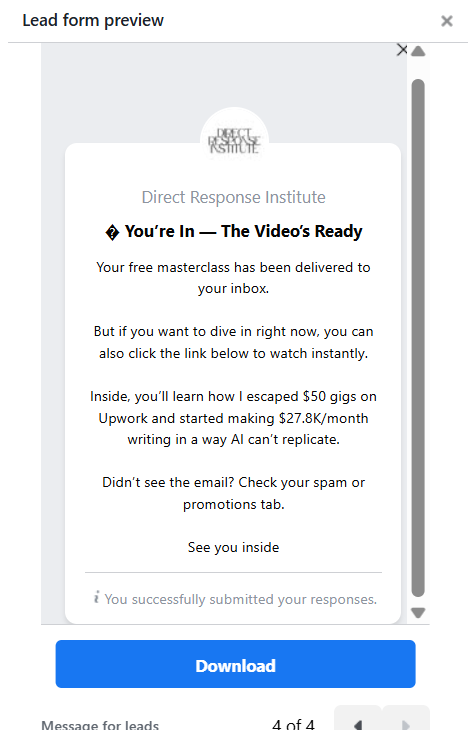

In any case, the lead form on Facebook looks like this:

The video that I sent is basically just this one — the first part of 4 of those videos I had originally made for my sister (SEE IT HERE).

So far in just a few days I have 150 leads.

None of them had to click on a link to visit a registration page, and my average CPL (cost per lead) is about $1.80, which is super good.

Not only that, they all gave me their phone numbers which is a very high quality lead and allows me to send SMS marketing.

This has me wondering why I’m even building out registration pages in the first place?

Why not nurture this audience (by the way you’re all seeing this email — welcome to my Substack) and hype of the live webinar and send them the link directly to register for the next event.

And for ads having a CTA to join the webinar, why not just have them register straight in this form as well?

It limits the friction and I can just sign them straight up to my webinar nurturing email / SMS sequence.

If you want to see the full ads / videos you can see them in the Facebook Ads Library by searching “Direct Response Institute” (try not to laugh too hard).

I think I’m just going to go ahead and do my first live webinar next week starting on Tuesday.

By then I should have about 300 or so leads.

The industry benchmark would be about a 20% show-up rate to the live webinar, so 60 people.

With about a 3% conversion rate that would be 2 or 3 buyers — so about $3,000 on the first webinar.

That’s not including post event emails to get people to watch the replay and all of that, which would be another one or two buyers.

So all in all I could make as much as $5,000 even with 300 leads on the first live webinar (and I plan to do one Tuesdays, Thursdays, and Sundays).

But we will see.

Of course the goal isn’t just to make money, it’s to deliver value.

And I intend to put the bulk of everything right back into more ad spend and expanding networks (like YouTube for example).

AI post coming soon I PROMISE.

See you later this week.

William

Thanks William! Looking forward to reading this now…

The more in depth story linked ‘HERE’ in the post goes to a private page that I can’t access? If you can link it again, appreciate it, thank you.